In case you need to issue a refund invoice for you guest, first, navigate to the affected reservation's page, scroll down to " Invoices " section and select the invoice that you would like to initiate the refund for.

Please note, refund invoice can be initiated only from a paid status invoice!

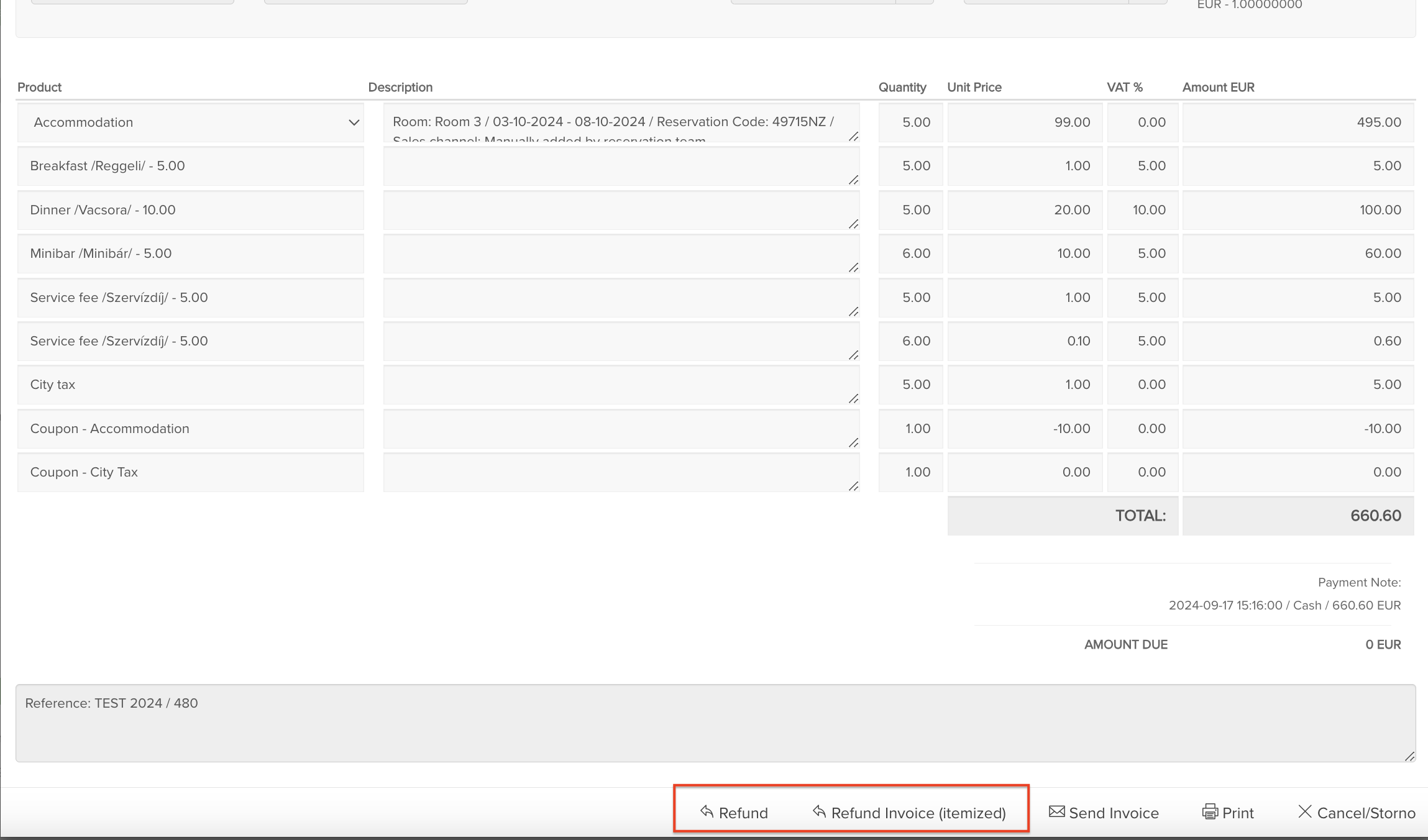

Once you opened the invoice, you will see the following two options:

( these two options are available for both individual & group reservations and both for paid final invoices & prepayment invoices )

( these two options are available for both individual & group reservations and both for paid final invoices & prepayment invoices )

Refund:

The main purpose of this type of refund invoice is to allow you to define a completely unique amount, regardless of the original invoice’s amount. In such case, after pressing the “ Refund “ option on an invoice the following is expected to displayed:

- refund invoice contains one “ Refund “ item only

- description field is by default empty, but you have the possibility to define any comments here

- item quantity is by default 1, it is not editable

- VAT % is by default the accommodation VAT % , it is not editable

In case it is a specific item that is to be refunded, we suggest to use the itemized refund option! - unit price & amount is by default the original invoice’s amount, but it can be edited

Only limitation implemented here is that the refunded amount can not be higher than the original invoice amount.

( If higher amount is defined here, the system automatically overrides it to the original invoice amount )

In case this Refund option is initiated from a final invoice, there will be a corresponding " Refund " Folio item generated in the Folio table:

This Refund item is always scheduled for the first night by default and it's status is initially set to 'Billed' making it unmodifiable and unselectable.

In the event of the refund invoice being cancelled, this corresponding refund element will be released and removed from the Folio.

In case this type of refund invoice is initiated from a Prepayment invoice ( itemized or not itemized ), there will be no Refund Folio item generated, as the prepayment invoices - thus the prepayment refunds are not linked to Folio items.

Refund ( itemized ):

The main purpose of the itemized refund invoice is to offer the possibility to refund only certain, selected items from the original invoice. Even in case the original invoice was created with using any of the item groupping options, when creating an itemized refund invoice, the previously groupped item categories will be unwrapped to individual items.

Let's see an example for the itemized refund:

In this example, we issued a final group invoice. The group reservation consists of 2 reservations, altogether 6 nights. When creating the final invoice, we used the " Group by reservations and categories " feature, meaning the 6 accommodation items were groupped together as follows:

Once the invoice is marked as paid, we initiate an itemized refund, because we would like to refund only 2 nights from the 6. We will see the following, after pressing the " Refund ( itemized ) button:

As visible, the 2 groups were unfolded to the original 6 accommodation items, this way the unnecessary ones can be deleted and the invoice can be locked with the remaining 2 items on it. After locking the invoice, the corresponding negative amount payment needs to be attched to the refund invoice, in order to be able to mark it as paid.

Once the refund invoice is created, the system automatically creates corresponding “ Accommodation ( refunded ) “ Folio items in the Folio:

In case there is an itemized refund invoice issued from a final invoice that did not have groupped items before, the same logic applies, those items will be listed on the refund invoice that were originally listed on the paid final invoice.

The order of the Folio items in case there are refunded items as well in the Folio:

1. Accommodation item ( and it’s corresponding refund item )

2. Services ( all of them listed first and then their corresponding refund items in the same order )

3. City tax ( and it’s corresponding refund item )

4. Coupon city tax ( and it’s corresponding refund item )

In case this type of refund invoice is initiated from a Prepayment invoice ( itemized or not itemized ), there will be no Refund Folio item generated, as the prepayment invoices - thus the prepayment refunds are not linked to Folio items.

Filtering for Refund invoices:

In the PMS / Invoice list menu, refund invoices can be filtered with the help of the 'Invoice type filter'.

Refund items and transactions in the reports:

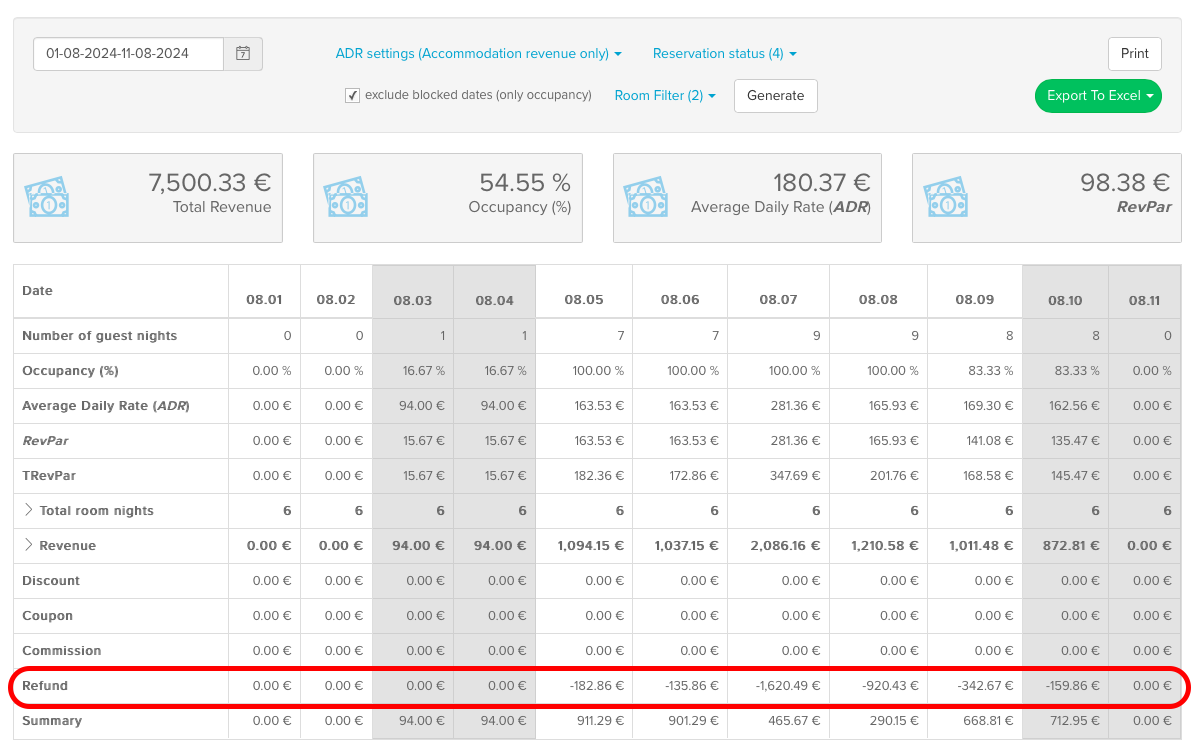

Daily & Yearly Performance Reports:

In both reports, you will find a row in the table called " Refund ". The refund line will summarize the total amount of refund Folio elements found within the specified interval. It aggregates the amounts of all refund Folio elements, regardless of their category, providing a comprehensive view of refunds processed within the given timeframe. For instance, if a reservation has one refund Folio element categorized as accommodation and another as breakfast, the refund line will display the total amount of both elements combined.

This line will remain fixed regardless of the filter settings. In cases where the selected filters do not yield relevant refund elements, the line will display a value of 0.

The displayed amount will be either net or gross, depending on the report settings.

Sales breakdown report:

The " refunded " type of Folio items will be listed in this report as well, assigned to their relevant category, thus the " Category " filter might come in handy when listing these items:

Transactions report:

Those negative amount payments that are attached to a refund invoice, will be listed in the transaction report: