Tax Settings

Choosing the correct tax model is crucial because it directly affects how your prices are calculated when you define them in the PRICES menu.

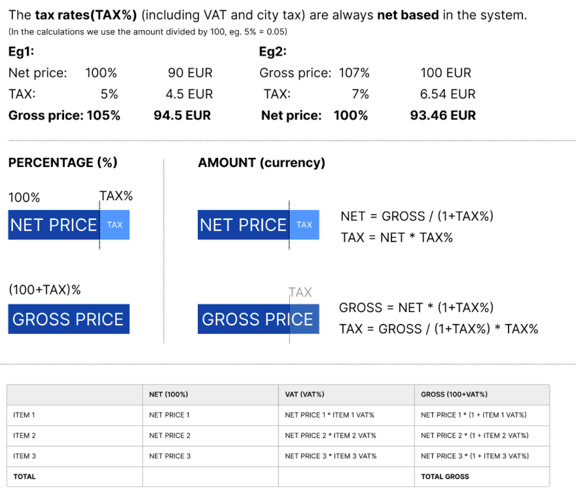

How do we handle prices in general?

- The daily price or rate price is the amount added in rate plan. As the B2C industry is daily rate based, our calculations are also based on daily rates.

Note: the price added manually to a booking is gross (incl. VAT and city tax), but the ratio of the price components is determined by the tax model.

- The price calculation method - which splits the price to accommodation fee, city tax and service items, and calculates net and gross amounts for each - is based on the tax settings (tax model selection, VAT and city tax settings) and service setup.

- The displayed prices in SabeeApp and on distribution channels might differ, and that is okay 🙂

Eg. 1: You have selected to use net base price in SabeeApp and on the channel extranet, but channel displays the gross amount for guests.

Eg. 2: Additional discounts are added on the channels.

Eg.3: Different currencies are used in SabeeApp and on the channels.

What components make up the price?

1. Accommodation fee

- Occupancy based or per room

- With or without children policy being applied

2. City tax

- Included or excluded

- Calculated as percentage or fix amount (per room or per adults)

- Based on net accommodation fee or gross accommodation fee, with or without service price (if applied)

- Option to apply for locals and/or non-locals (based on user’s and guest’s country)

3. VAT

- Included or excluded

- Based on accommodation fee or accommodation fee plus city tax

- Possibility to apply different VAT% for local and non-local guests

4. Service(s)

Service prices are deducted from prices first, regardless the tax model

- Included, derived (or excluded)

- Option to apply service fee (~tip, incl. or excl, % or fix amount) and/or city tax for service price

When included, the service price is part of the accommodation fee.

When derived, the service price is calculated from the accommodation fee in an inclusive way, displayed as a separate charge item

When excluded, the service fee is calculated on top of the accommodation fee, displayed as a separate charge item

PRICE COMPOSITION WITH SERVICE

What is SabeeApp's responsibility, and what is the user's responsibility?

SabeeApp's Responsibility

- SabeeApp will keep price calculation options and communications clear.

- SabeeApp will ensure that price calculation methods remain accurate, as long as there is configuration parity between SabeeApp and the channel(s).

- SabeeApp will investigate and validate change requests related to product and business development and inform users of the results.

User's Responsibility

- Users must be aware of the regulations that apply to them.

- Users should familiarize themselves with SabeeApp's pricing options and choose the correct tax model based on their needs (with the support of their Account Manager).

- Users should communicate if their needs are not being met.

- Users need to check that prices are correct both in SabeeApp and on the channels after synchronisation.

BEFORE CHOOSING TAX MODEL

Tax Calculation

Tax exemption (AAM) 🇭🇺

This feature is available for tax-free (“alanyi adómentes” or “AAM”) users, and can only be used if the user’s country is Hungary and Multi-Company Invoicing is not active.

Users eligible for AAM should activate this function until the upper revenue limit specified by regulation (18M HUF as of 2025) is reached. Activating this will set the VAT rate to 0%, and "AAM" will appear in the VAT section of the invoice items. Once the legal revenue limit is reached, the function must be turned off manually, and the appropriate VAT rate should be applied. After that, VAT amounts will be calculated based on the selected tax model and tax rate, and displayed on both the folio and the invoice.

This means it’s a good idea for users to select a tax model from the start that will continue to work once the VAT payment obligation comes into effect.

Environmental tax (“Green tax”) 🇬🇷

This feature is designed for Greek users, and can only be used if the user’s country is Greece.

Guests staying in Greek accommodations are required to pay an environmental tax. The tax amount depends on the accommodation type, classification, and seasonality, and it is charged per room night. The environmental tax for both low and high season can be set in the tax settings menu.

It’s important to note that the environmental tax is always added on top of the daily price (net accommodation fee + VAT + city tax) for the reservation, regardless of the tax model. This tax does not include VAT.

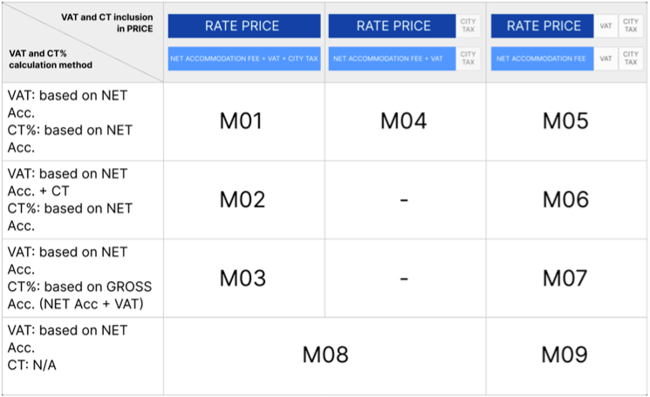

TAX MODELS

Please use the diagrams below to select the appropriate tax model.

1. City tax is percentage- based or not applicable

2. City tax is fix amount per room or guest

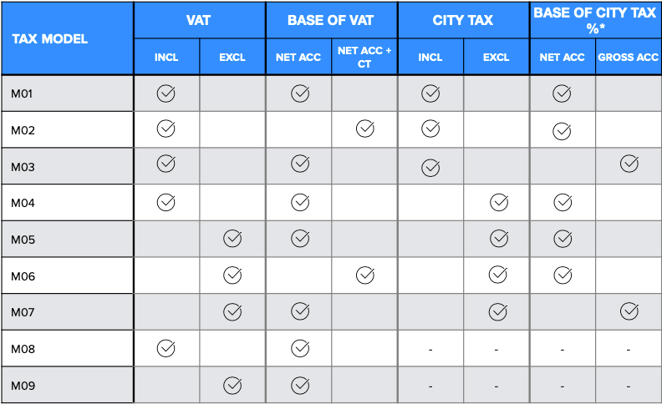

Use the following comparison chart and summary chart to verify that you have selected the correct model.

TAX MODEL COMPARISON

TAX MODEL SUMMARY

* Base of city tax only applicable when the city tax calculation method is %.

This means that M01-M03 and M05-M07 are identical when the city tax is a fix amount.

Setting up VAT and City Tax:

Once you have selected the correct Tax model, you need to define the VAT and City tax:

Default VAT:

Default VAT:

This is the basic tax for accommodation services defined by your tax authorities.

Local Resident VAT:

Local residents might be subject to a different VAT or VAT might not apply to them at all. You can specify this information in this field.

Apply City Tax for Non-locals:

You can separately calculate City Tax for clients who are not from your property's country of origin.

Apply City Tax for Locals:

You can separately calculate City Tax for clients who are from your property's country of origin.

City Tax Calculation:

You can specify the calculation of city tax here. It can be based on a Percentage, Fixed - per person, or Fixed - per room.

If you have multiple city tax rates for different locations (commonly seen with apartment rentals), ensure that you set the default city tax rate here. For more details on how to configure city tax rates specific to room types, please refer to the room-type-based city tax settings help article.

City Tax Amount:

You can define the exact amount or percentage of your City Tax here.

After finalising your tax settings, you can choose one of two options:

- Apply to Future Reservations (Including Existing Bookings with Future Arrival Dates):

- Click the "Update and Apply for Future Reservations" button.

- This will apply the new tax model or changes to: Existing reservations already in the system with an arrival date in the future (starting from tomorrow) and all new bookings made after the changes are saved.

- Apply Only to New Reservations:

- Click the "Update and Don't Apply for Existing Reservations" button.

- The new tax settings will apply only to reservations that are made after the changes are saved. Existing bookings will remain unaffected.

Please note: Changing the Tax Model is not possible within your account settings. If you selected the wrong tax model, please contact your SabeeApp Account Manager to update it for you.

If you're still unsure about which tax model to apply in your SabeeApp account after reviewing this help article, please don't hesitate to contact your account manager for further guidance.